Introduction

In the complex world of non-profit organizations, financial survival is more than just balancing books—it’s about sustaining hope, creating change, and transforming communities. Charities face unprecedented financial challenges, battling unpredictable funding streams, limited resources, and increasing operational costs. Enter Jones Financial Planning for Charities, a revolutionary approach that transforms how charitable organizations manage their financial health and mission-driven objectives. Mastering Non-Profit Financials: Jones Financial Planning for Charities Comprehensive Guide.

The landscape of the charitable sector demands more than traditional financial management. Non-profits require a strategic, holistic approach that aligns fiscal responsibility with their core mission. Financial stability is no longer a luxury but a critical necessity for organizations seeking to make meaningful, long-lasting impacts.

What is Jones Financial Planning for Charities?

Jones Financial Planning emerges as a specialized financial strategy tailored exclusively for non-profit organizations. This innovative approach addresses the unique financial ecosystem of charities, providing a comprehensive framework that goes beyond conventional financial management. By recognizing the distinctive challenges faced by non-profits, this methodology offers a nuanced approach to fiscal management.

At its core, Jones Financial Planning for Charities focuses on creating a symbiotic relationship between financial practices and organizational missions. It’s not just about managing money—it’s about empowering charities to achieve their most ambitious goals while maintaining robust financial health. The strategy considers the intricate balance between limited resources and expansive community needs.

Understanding the Non-Profit Financial Landscape

Non-profits operate in a uniquely challenging financial environment. Unlike corporate entities, they must navigate complex funding mechanisms, demonstrate absolute transparency, and maximize every dollar’s impact. Funding channels are often unpredictable, with grant opportunities and community fundraisers representing critical lifelines for organizational sustainability. Mastering Non-Profit Financials: Jones Financial Planning for Charities Comprehensive Guide.

The Core Principles of Jones Financial Planning

Mission Alignment: The Heart of Financial Strategy

Mission alignment stands as the foundational principle of Jones Financial Planning. Every financial decision must directly support the organization’s core objectives. This means transforming financial management from a purely administrative function to a strategic tool that propels the charity’s vision forward.

Sustainable Funding: Diversifying Financial Resources

Diversifying funding sources becomes crucial in mitigating financial risks. By developing multiple revenue streams, non-profits can reduce dependency on single donors or funding mechanisms. This approach might include exploring community fundraisers, applying for diverse grant opportunities, and developing innovative funding strategies.

Cost Management: Maximizing Resource Efficiency

Cost management involves a meticulous approach to resource allocation. Non-profits must scrutinize every expenditure, ensuring that funds are channeled towards mission-critical activities. This doesn’t mean cutting corners but strategically optimizing spending to maximize community impact.

Advantages of Implementing Jones Financial Planning

Enhanced Financial Health and Operational Efficiency

Organizations implementing this strategy experience significant improvements in financial health. By developing a comprehensive budget and establishing clear financial objectives, charities can create a robust framework for sustainable growth. Operational efficiency increases as financial processes become more streamlined and strategic.

Strategic Growth and Risk Mitigation

Strategic growth opportunities emerge when non-profits adopt a proactive financial approach. The methodology helps organizations build a reserve fund, prepare for economic downturns, and create resilient financial structures. Risk mitigation becomes a tangible reality rather than a distant aspiration. Mastering Non-Profit Financials: Jones Financial Planning for Charities Comprehensive Guide.

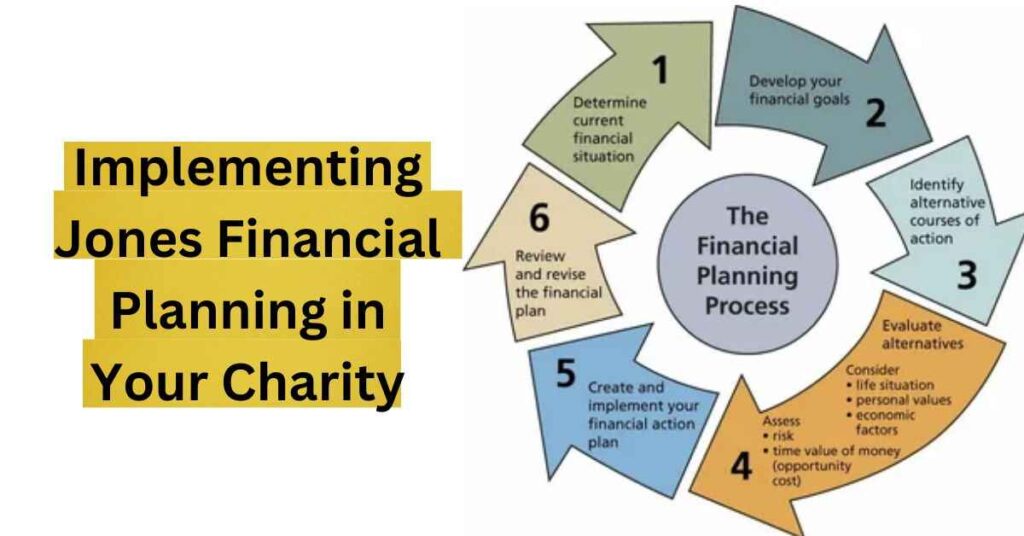

Implementing Jones Financial Planning in Your Charity

A Step-by-Step Implementation Guide

Implementation requires a methodical approach. Begin with a comprehensive financial audit to understand current financial standings. Develop clear, measurable financial objectives that align with your organization’s mission. Create a comprehensive budget that allows flexibility while maintaining fiscal discipline.

Technology and Capability Investment

Modern financial management demands technological integration. Invest in robust financial software, train staff in advanced financial reporting techniques, and develop systems that promote transparency and accountability.

Case Study: Transforming Hope Through Strategic Financial Planning

Hope for Tomorrow: A Real-World Success Story

“Hope for Tomorrow,” a youth education non-profit, exemplifies the transformative power of Jones Financial Planning. By implementing strategic financial practices, they increased funding by 25%, expanded educational programs, and built a substantial reserve fund. Their journey demonstrates how targeted financial strategies can dramatically enhance a charity’s impact.

Conclusion: Empowering Charities Through Strategic Financial Management

Jones Financial Planning for Charities represents more than a financial strategy—it’s a comprehensive approach to charity sustainability. By embracing these principles, non-profits can transform financial challenges into opportunities for growth, impact, and meaningful change.

Frequently Asked Questions about Jones Financial Planning

- What makes Jones Financial Planning unique?

A specialized approach focusing on non-profit financial nuances and mission alignment. - How frequently should a financial plan be reviewed?

Annually, or more frequently during significant organizational changes. - Can small charities benefit from this approach?

Absolutely. The principles are scalable and adaptable to organizations of all sizes.